Motor vehicle importer fined $5.6 million for evading Customs duty and GST on 464 vehicles

A Singaporean motor vehicle importer was fined about $5.63 million on Wednesday (March 9) for evading Customs duty and goods and services tax (GST) on 464 vehicles he had imported into Singapore.

He had done this in 2016 by under-declaring their value.

As he did not pay the fine, Lin Junjiang, 39, was instead jailed for three years and four months in default.

He also has to serve an additional four weeks in prison for underpaying the additional registration fee (ARF) of some of these vehicles.

In a statement on Thursday, Singapore Customs said Lin, the sole proprietor of J21 Imports, pleaded guilty to an offence under the Customs Act and another offence under the Road Traffic Act for giving incorrect information related to vehicle tax.

A second Customs-related charge was taken into consideration during sentencing.

Singapore Customs said it started investigating J21 Imports after it noticed that the company did not declare the value of optional features for the 464 vehicles in order for the agency to assess the duty and GST payable on them.

The vehicles were imported into Singapore over a five-month period between June and November 2016.

Investigations revealed that two invoices would be prepared for each imported vehicle transaction.

The first invoice would state the partial value of the vehicle, while the other invoice would indicate the vehicle's balance value and falsely describe it as a "liaison fee".

J21 Imports had only declared the partial value in the first invoice but failed to declare the "liaison fee", despite knowing that this amount had to be declared, Singapore Customs said.

The intentional omission of the "liaison fee" from these declarations resulted in a shortfall of about $704,000 in Customs duties and about $295,000 in GST payments.

Singapore Customs said the under-declaration of the values of 67 of the 464 vehicles also led to an ARF shortfall of about $567,000, which was to be paid to the Land Transport Authority.

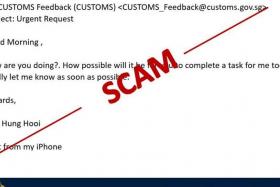

It added that members of the public with information on smuggling activities or evasion of duty or GST can call the Singapore Customs hotline on 1800-233-0000 or e-mail it at customs_intelligence@customs.gov.sg

Anyone convicted of the fraudulent evasion of Customs duty or excise duty can be fined up to 20 times the amount of duty and GST evaded.

For giving incorrect information related to vehicle tax, those convicted can be fined up to $10,000 or be jailed for up to six months.

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now