All you need to know about Budget 2023

Deputy Prime Minister and Finance Minister Lawrence Wong announced more support measures and payouts to help households, workers and businesses deal with inflation in the Budget speech on Tuesday.

Here are some highlights from his speech:

1. Assurance Package top-ups and payouts

A total of $3 billion will be pumped into the Assurance Package. The package will cost $9.6 billion, up from $6.6 billion.

Payouts will come in the form of a new Cost-of-Living Special Payment of between $200 and $400 for each eligible adult Singaporean. An additional senior bonus of between $200 and $300 will be given to each eligible Singaporean aged 55 and above.

Cash payouts will be increased by between $300 and $650 for eligible Singaporeans, bringing the total amount received by each adult Singaporean to between $700 and $2,250 over five years.

Singaporean households will also receive $300 in Community Development Council (CDC) vouchers in January 2024, up from the $200 the Government had earlier announced.

READ FULL STORY: S’poreans to get more in GST voucher, cash payouts to cope with rising costs

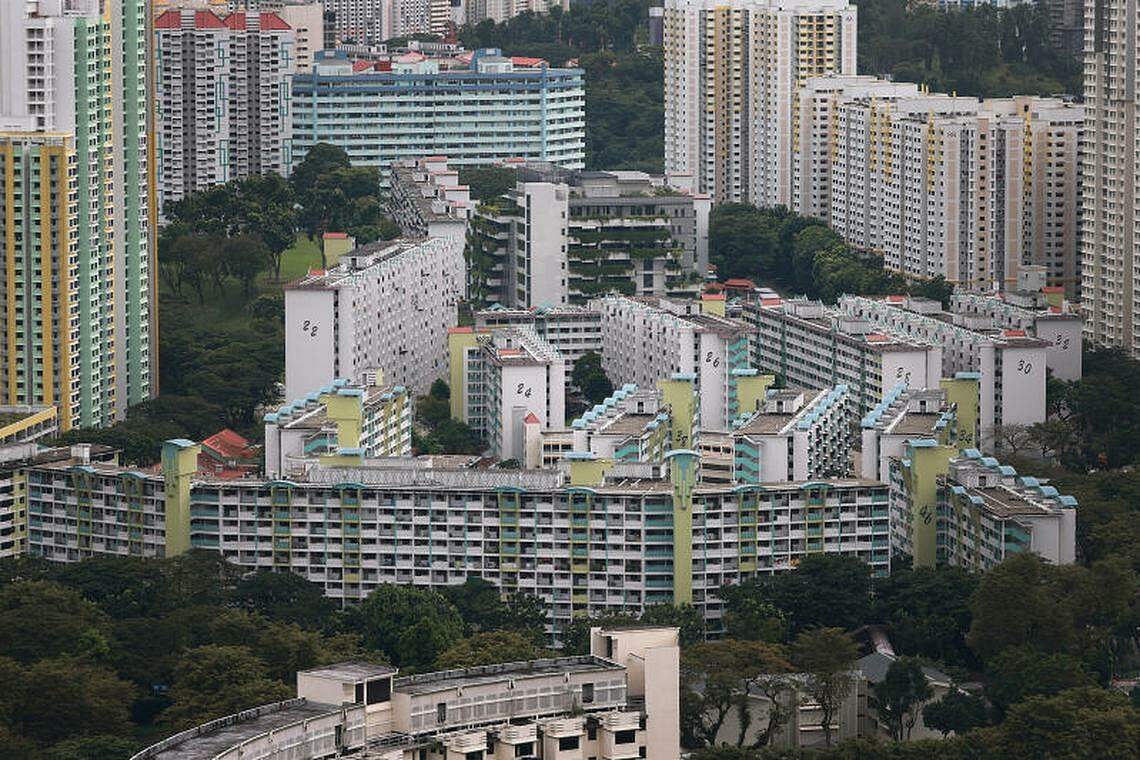

2. Housing measures and grants

Families with young children, as well as married couples aged 40 and younger buying their first home will get more support in their house hunt.

This group of home seekers will get an additional ballot chance for their first Build-To-Order flat application. This will be implemented later in 2023.

For those buying resale flats, the Central Provident Fund Housing Grant will, with immediate effect, be increased from $50,000 to $80,000 for eligible families purchasing four-room or smaller resale flats for the first time, and from $40,000 to $50,000 for those buying five-room or larger flats.

3. Higher taxes for high-value property, luxury cars and tobacco

Buyer’s stamp duty for residential properties: The portion of the property’s value in excess of $1.5 million, and up to $3 million, will be taxed at 5 per cent, up from the current 3 per cent. The portion in excess of $3 million will be taxed at 6 per cent, up from the current 4 per cent.

Luxury cars: Buyers of vehicles with open market value (OMV) of more than $40,000 will pay higher marginal additional registration fee (ARF) rates than they do today. For the highest OMV tier, the revised ARF rates will be 320 per cent, up from 220 per cent today.

Tobacco: Excise duty across all tobacco products will increase by 15 per cent from Feb 14, 2023.

READ FULL STORY: Help to weather inflation, more progressive property and vehicle taxes

4. CPF monthly salary ceiling to rise

The CPF monthly salary ceiling will be increased from $6,000 to $8,000 in 2026 to keep pace with rising salaries.

The increases will be phased in over four years, starting from 2023, to allow employers and employees to adjust to the changes.

READ FULL STORY: CPF monthly salary ceiling to be raised to $8,000 by 2026

5. Baby Bonus boost

The Baby Bonus cash gift will be increased by $3,000 for all eligible Singaporean children born on Feb 14, 2023 and after. This means first and second children will receive $11,000, up from $8,000. For the third child onwards, the gift will be $13,000, up from $10,000.

Parents can expect up to $9,000 in payouts in the first 18 months of the child’s life. Subsequently, $400 will be paid out every six months starting from when the child is two years old until the child turns 6½.

Government-paid paternity leave will be doubled from two weeks to four weeks for eligible working fathers of Singaporean children born on or after Jan 1, 2024.

The one-off Baby Support Grant of $3,000 will be extended to children born from Oct 1, 2022 to Feb 13, 2023. It was previously for children born from Oct 1, 2020 to Sept 30, 2022.

READ FULL STORY: $3k more in baby bonus, more financial support for children’s early years

6. More support for workers

The Government will continue to provide wage offsets until 2025 to employers who hire senior workers.

It will extend the Part-time Re-employment Grant until 2025 to encourage employers to offer part-time re-employment, other flexible work arrangements, and structured career planning to senior workers.

It will pilot the role of Job-Skills Integrators in precision engineering, retail and wholesale trade sectors. These integrators, which can be existing institutions, will engage enterprises to understand the manpower and skills gaps in the sector and work with training providers to close these gaps.

To encourage firms to employ former offenders, the Government will introduce the Uplifting Employment Credit to provide wage offsets for a limited time.

READ FULL FULL STORY: Jobs-Skills Integrators to ensure training leads to good job prospects

7. Tax deductions for donations extended

The 250 per cent tax deduction for donations to Institutions of a Public Character, or registered charities, and eligible institutions which was announced in Budget 2021 will be extended for three years to the end of 2026.

To further support social service agencies that serve seniors, there will be a $1 billion top-up to the Community Silver Trust that allows the Government to match donations dollar for dollar.

READ FULL STORY: Govt to extend 250% tax deduction for donations until 2026

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now