Are consumer staples stocks perishing?

Last year's top-performing sector has been registering the lowest gains in the year-to-date

When online retail giant Amazon announced its plan to buy upmarket American supermarket chain Whole Foods two weeks ago, investors of traditional retailers took notice.

The US consumer staples sector - heavily populated by the shares of grocers - fell 1.8 per cent on the same day.

In Singapore, the consumer staples sector, which is mostly focused on food, beverages and other non-durable products and services, is not just facing the challenges of technological disruptions.

Its performance in the year so far has been muted, especially compared to last year, when it was the top-performing sector, noted the Singapore Exchange (SGX) in a report last Friday.

In the year-to-date, the sector registered some of the lowest gains in the stock market, with indicative total returns of 5 per cent. In contrast, the best performing sector, information technology, had an indicative total returns of 44 per cent.

At a media briefing on Tuesday, SGX market strategist Geoff Howie said the consumer staples sector's relatively poor performance is a good example of "sector rotation".

He added: "It could be investors who choose a different sector at different times. Last year, after consumer staples was the strongest performer for many months and had already generated much of its returns in the first six months of 2016, some investors rotated to the financials sector after the results of the US election."

In its report last Friday, SGX also highlighted that the consumer staples sector is traditionally known as a more defensive, rather than cyclical, sector.

Defensive stocks are usually resilient during periods of economic downturns, and their performances are not closely related to the economic cycle.

On the other hand, companies that offer consumer discretionary products, such as cars, would be more affected by an economy slump, as purchasing power and consumer sentiment are affected.

"(This) may provide a part explanation for (the consumer staples sector's) better performance last year, when most broad benchmarks were lower," noted the report.

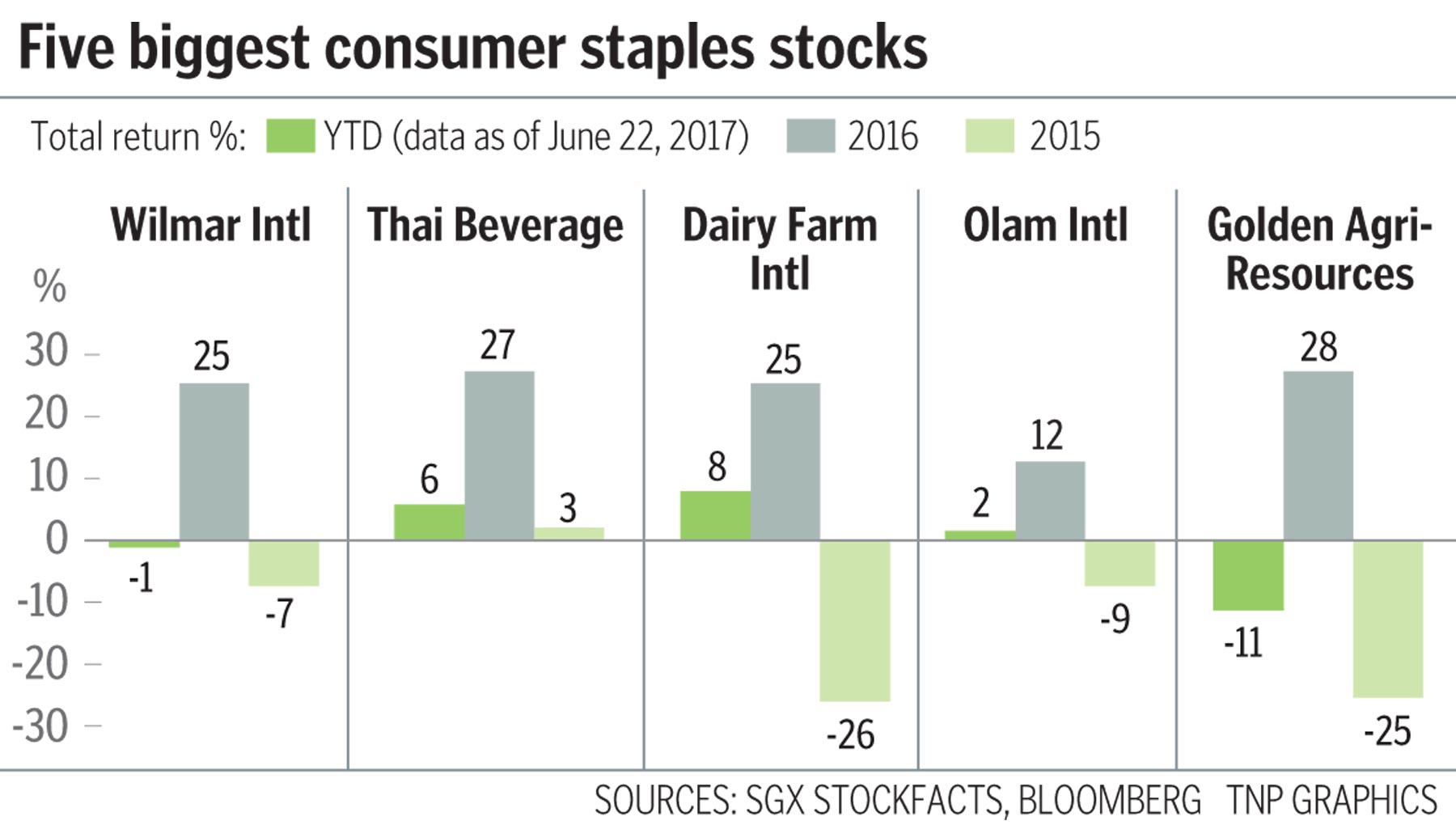

Last year, consumer staples was the strongest segment within the Straits Times Index (STI), with three stocks - Thai Beverage, Wilmar International and Golden Agri-Resources - making the top five performing STI stocks of the year, noted an SGX report on Tuesday.But this year, the 20 biggest stocks of the consumer staples sector have averaged a 2 per cent market capitalisation weighted average return, a stark contrast to its 23 per cent gain last year.

The least-performing STI constituent in this year's year-to-date is Golden Agri Resources, which was the best performing STI stock last year.

Last year, it registered a 28 per cent total return. In the year-to-date, its total return is -11 per cent.

Thai Beverage, Wilmar International and Dairy Farm International are the three largest consumer staples stocks by market capitalisation.

Most would also be familiar with Fraser and Neave (sixth biggest consumer staples stock, and the company behind 100PLUS and F&N Sparkling Drinks) and supermarket chain Sheng Siong Group (eighth biggest).

Mr Howie noted that there are "bright spots" among the sector: "At certain periods, the returns of consumer staples might not appear so competitive. But on a year-to-year basis, it has provided a great opportunity for investors who rotate their portfolios regularly by switching to consumer staples that focus on China, for instance."

INTERNATIONAL EXPOSURE

The three strongest performers of the 20 consumer staples stocks were Best World International, Hanwell Holdings and Food Empire Holdings (see report above, right). All three stocks operate international consumer-orientated businesses.

In the year-to-date, Best World generated a 120 per cent price gain, while Hanwell and Food Empire generated similar gains of 48 per cent and 42 per cent respectively, noted SGX.

Plus, the long-term consumer sector growth in Singapore has outpaced the region.

The value of Singapore's consumer stocks saw a seven-fold jump over the past 20 years, compared to the six-fold increase in Asia-Pacific over the same period.

The sector also plays an important role in the local stock market, contributing 15 per cent of its daily turnover.

Although technology and rising Internet use will "disrupt" traditional businesses, it will also be a driver behind the consumer sector in Asia, beyond China and India, said Mr Howie.

Approximately a fifth of total retail sales will take place online by 2021 in the Asia-Pacific, and China is expected to reach $1 trillion in online retail sales in 2020.

"Technology disruptors are not only going to affect the tech industry but the consumers industry as well," added Mr Howie.

Top consumer staples stocks

Long-term investors of these three Singapore-based consumer staples companies would be glad to know that they all reported higher diluted Earnings Per Share (EPS) in the first quarter of this year.

For instance, Best World's diluted EPS of 3.53 cents was a 62.7 per cent increase year-on-year. Hanwell's EPS of 0.15 cents was a 36.4 per cent jump year-on-year, while Food Empire saw a 56 per cent leap over the same period.

Here is more information about these companies:

BEST WORLD INTERNATIONAL

The company distributes a range of skincare, personal care, nutritional and wellness products to customers through its direct selling network in 12 markets.

HANWELL HOLDINGS

The firm primarily supplies provisions and household consumer products such as rice, oil and detergents locally, as well as in Malaysia and China.

FOOD EMPIRE HOLDINGS

The Singapore brand sells its products, which range from instant beverage to frozen convenience food, to approximately 50 countries.

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now