Imposter stole her identity and got bank to release $94K

Nepalese doctor loses $94,000 to imposter

On her 70th birthday, instead of celebrating with a big bash, she was crying her heart out in a hotel room in Singapore.

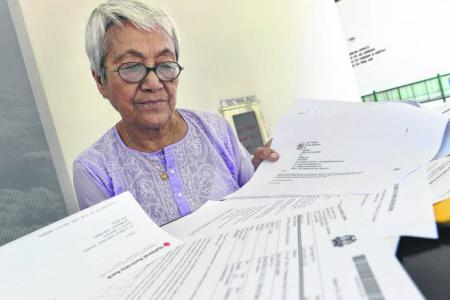

Retired Nepalese doctor Nirmala Sherchand Sakarailost NZ$89,000 (S$94,000) to an imposter who had swiped her identity.

The person had hacked into her e-mail account and instructed the National Australia Bank (NAB) to transfer the money out of her account.

Somehow, the conman got a copy of her passport, her future address and even her signature to convince the bank to effect the transfer.

Two weeks ago, the courts convicted the man whose account was used to receive the stolen money.

Muhammad Hafidz Yeo, 60, a former security guard, was sentenced to 12 months' jail.

The identity of the person who posed as her remains unknown.

Dr Nirmala is not alone. Lawyers The New Paper on Sunday spoke to say cases of identity theft like this is not all that uncommon in Singapore. (See report on right.)

Recently in Japan, the gruesome discovery of Ms Rika Okada's corpse that had been shipped as a doll revealed a case where the killer adopted the victim's identity and sent messages to Ms Okada's family and workplace.

The 29-year-old nurse was found in a Tokyo storage lock-up, which was rented using a credit card in her name.

Dr Nirmala's imposter was discovered when she migrated her Hotmail account to Outlook on April 7 last year.

In the process, she noticed an option to restore her deleted messages.

Intrigued, she opted to restore the e-mail and to her horror, found a flurry of unfamiliar e-mail communication with the NAB.

She had a fixed deposit account with its Singapore branch, as "Singapore is known to be safe", she says.

She tells The New Paper on Sunday: "I was shocked out of my boots. Someone must have been sending e-mail after e-mail to the bank and deleting them after that."

There were about 15 of them and she replied each of them to say it wasn't from her and not to act on it.

But it was too late as the money transfer had been effected by then.

One e-mail, sent by the conman on March 19 last year, asked for the current value in her account.

When questioned by the bank, the conman said the money transfer was meant for a property purchase.

The imposter gave excuses that he was out of town when the bank tried to make contact for verification.

From the e-mail exchanges that TNP obtained, the imposter started getting impatient with the bank and the money was released.

About a week later, the conman tried the same modus operandi.

This time, the bank asked for more documents, including a copy of Dr Nirmala's passport and a signed withdrawal instruction.

Amazingly, the imposter was able to fax over the documents, which chills Dr Nirmala to the bone.

Three days after the shocking discovery, Dr Nirmala - who resides in Kathmandu, Nepal - flew here to make a police report.

She had to cancel the birthday bash planned for her 70th birthday on April 14 where 68 guests had been invited.

She says: "I had to call everyone and apologise, and said I had to go.

"On my 70th birthday, I was alone in Singapore, sitting in my hotel room, crying by myself."

She says that the bank initially refused to refund her the money and she had to write to the Monetary Authority of Singapore and engage a lawyer.

The money was reinstated months later but she had to fork out about $12,000 for her lawyers' fees.

The amount of money is huge in Nepali terms, she says.

"For the amount of money I spend in Singapore or New Zealand for a month, say $2,000, I can live for five months in Nepal," she says.

She adds: "All my life, I have been independent. I've worked hard all my life. Now, I'm not earning. I'm old. This is for my old age."

She says she suffered mentally when the case was pending.

"For the whole year, I was so afraid of everything.

"By the end of all this, I was feeling very depressed. I wasn't myself at all.

"The whole thing overshadowed me," she says. The episode also left her wary of people.

She has since closed the fixed deposit account and used the money to build a house nearer to her siblings in Nepal.

When contacted, the bank confirmed that the money has been returned to Dr Nirmala in full and that no employee was involved in any way.

Its spokesman says: "NAB does not comment on specific customer cases for privacy reasons.

"The bank takes fraud very seriously and advises all customers to ensure they take precautions to protect their personal and business information."

More tech, so higher chance of ID theft

Cases of identity theft are not that uncommon in Singapore, say lawyers The New Paper on Sunday spoke to.

On average, they see two to three cases a year. And the figure is expected to rise, says criminal lawyer Choo Zheng Xi, who saw three or four cases in the past two years.

He says: "With increased prevalence of technology to effect transaction, it will happen more often."

On Wednesday, it was announced that 1,500 SingPass passwords had been reset. It is yet unclear whether there has been more impact.

Ms Gloria James, a lawyer with Gloria James-Civetta & Co who has seen about 20 cases of identity theft in seven years, says identity theft comes in different forms and can take place in a variety of settings.

Some of the common cases her law firm has seen involved online Internet fraud, cross-border money laundering and unauthorised use of credit cards.

Most times, the perpetrators are financially motivated, she says.

Ms James' husband, too, fell prey to an identity thief. She says: "He had his identity stolen and the culprit went into his bank account online, changed his mobile number, reset the PIN and went on to draw monies from his account in Melbourne, when at all times he was in Singapore."

She puts the sums of money involved in credit card fraud to as much as $100,000, while cheque forgery could go higher.

"But online stolen identity, where one is deceived to transfer money to the culprit, can hit more than a million dollars," she says.

Lawyer Salem Ibrahim says the identity thieves' success can be thwarted if the bank's safeguards and protocols are strong.

He says: "Where the perpetrator succeeds, it is because the bank's officer have been convinced by the perpetrator."

Past victims

Convicted for crimes I didn't commit

Mr Sha'Aban Yahya was arrested in 2009 for a crime he did not commit.

That was when he found out someone had been masquerading as him for years, committing crimes such as theft and housebreaking, and had been in and out of prison five times.

His record was finally wiped clean last April 5 after the authorities made an application in the High Court to quash the convictions against him.

His mistaken arrest was believed to have sparked off a major police review of its entire database of more than 500,000 criminal records.

It found another six people whose identities had been stolen and convicted without their knowledge. Their records were also set straight.

Someone applied for loans under my name

She was in the midst of her wedding preparations and wanted to apply for new credit cards and renovation loans.

But she her applications were denied.

The finance executive later discovered by chance that her colleague had stolen her identity to apply for loans under her name.

Ms Renee Tan, 29, found out only two years after it happened, reported SimplyHer magazine in April 2011.

She confronted the colleague who admitted to taking a photocopy of her IC when she was away from her desk

The colleague also figured out how to forge Ms Tan's signature by examining Ms Tan's credit card.

Someone applied for seven phone lines in my name

He lost his bag after a session at the gym. Then, he received mobile phone bills in his name for $1,015, reported The New Paper in January 2007.

Mr Gavin Tan, who was 22 and an undergraduate then, had his Singapore Armed Forces identity card in the bag.

He found out about the phone lines when he received congratulatory letters from M1. He also received bills for four lines with StarHub.

He terminated all of them.

Guarding against identity theft

1. Keep your bank token separate from the details of your bank account and do not put them in the same place with your login details and mobile phone.

2. Regularly update computer firewall and anti-virus

3. Do not save login details on your computer and clear it of all sensitive information before selling or getting rid of it.

4. Clear the cache after each Internet banking transaction.

5. Strengthen your password/PIN security and access your account often to make sure there have been no unauthorised debits.

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now